TOKENOMICS

TODAY’S CAELUM, TOMORROW’S HERITAGE

TOKENOMICS

Caelum (ticker symbol CAEL) is a functional multi-utility token that will be used as the medium of exchange between participants on the Cael Commodity Trading Platform in a decentralized manner. The goal of introducing CAEL is to provide a convenient and secure mode of payment and settlement between participants who interact within the ecosystem without intermediaries such as centralized third-party entities/institutions.

CAEL may only be utilized on the Cael Commodity Trading Platform as the medium of exchange for products/services provided in the ecosystem. The costs for each exchange of services are quantified in CAEL and paid to the platform and/or the other party providing the service.

CAEL would also function as the incentive which would be distributed to encourage users to exert efforts towards contribution and participation in the ecosystem. Further, additional CAEL will be awarded to a user based only on its actual usage, activity, and efforts made on the CAEL platform (and/or proportionate to the frequency and volume of transactions).

CAEL has the following specific features:

- CAEL functions as the native platform currency, which will be used as the unit of account for settling all trading and conversion transactions on the platform.

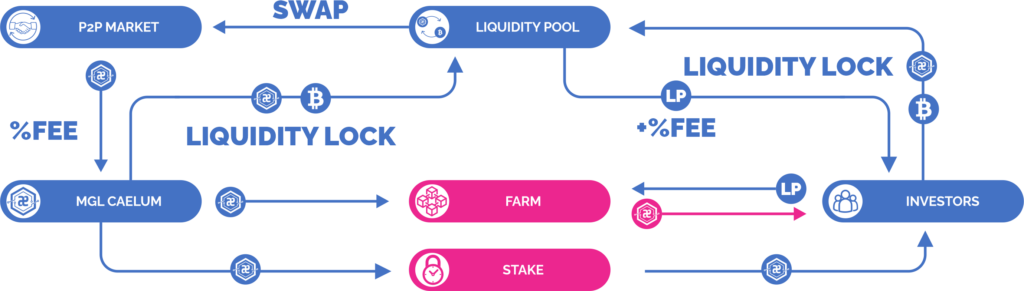

- CAEL will also be used to pay for platform and network fees. CAEL will be further distributed to active participants, such as users who utilize services for trading, interactions, securing networks, or providing liquidity in the AMM liquidity pools.

- The Cael Commodity Trading Platform also does not own or run any computing/storage servers, relying on an open, decentralized network of nodes to ensure network security and prevent attacks. Accordingly, third-party computing/bandwidth/storage resources are required for processing transactions and running applications on the platform, as well as validating and verifying additional blocks/information on the blockchain. Providers of these services/resources would require payment for the consumption of these resources to maintain network integrity. CAEL will be used as the native “gas” to quantify and pay the costs of the consumed computing/bandwidth/storage resources.

- To ensure that users receive access to CAEL so that they may utilize these for platform services, other users would need to be incentivized to become liquidity providers and stake their digital asset pairs (e.g., USDT/CAEL) in the decentralized market, making pools to (provide the necessary liquidity for transactions. As compensation for opportunity costs, these liquidity providers which help to promote the adoption of the platform by staking or including assets to liquidity pools in exchange for LP tokens would be rewarded with CAEL (i.e., “mining” on the CAEL platform), according to each user’s relative contribution after various adjustment and correction parameters. In addition, the liquidity provider will also earn a portion of the trading fees paid by traders to utilize the liquidity.

Token Distribution Model

INTERNATIONAL MARKET

ECOSYSTEM DEVELOPMENT

PROJECT TEAM AND ADVISORS

BOUNTY, AIRDROP AND BONUS

MONGOLIAN MARKET

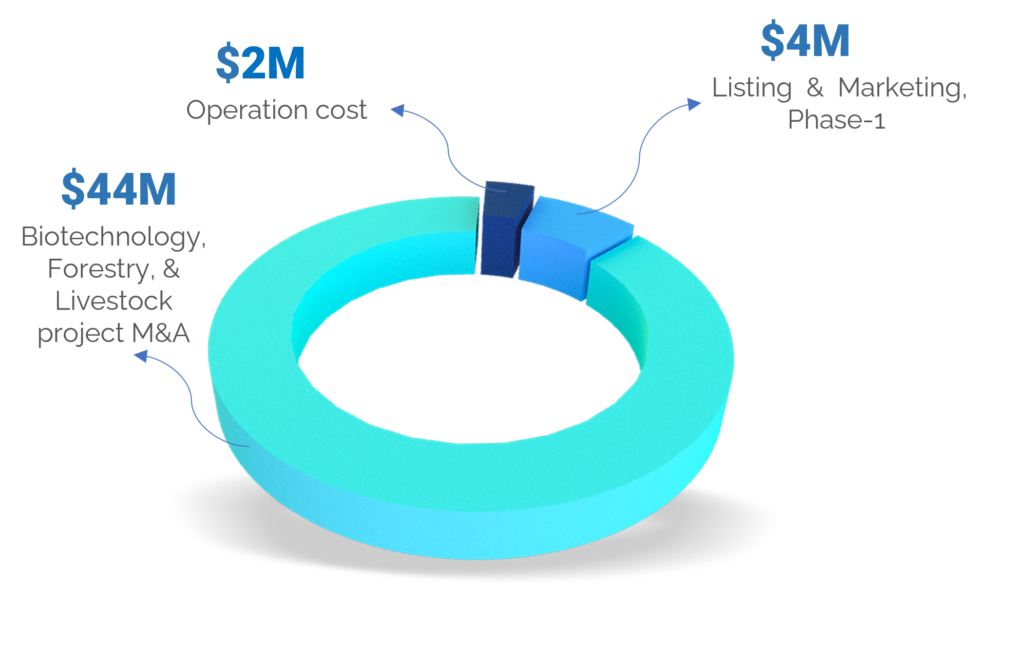

$50M DISTRIBUTION

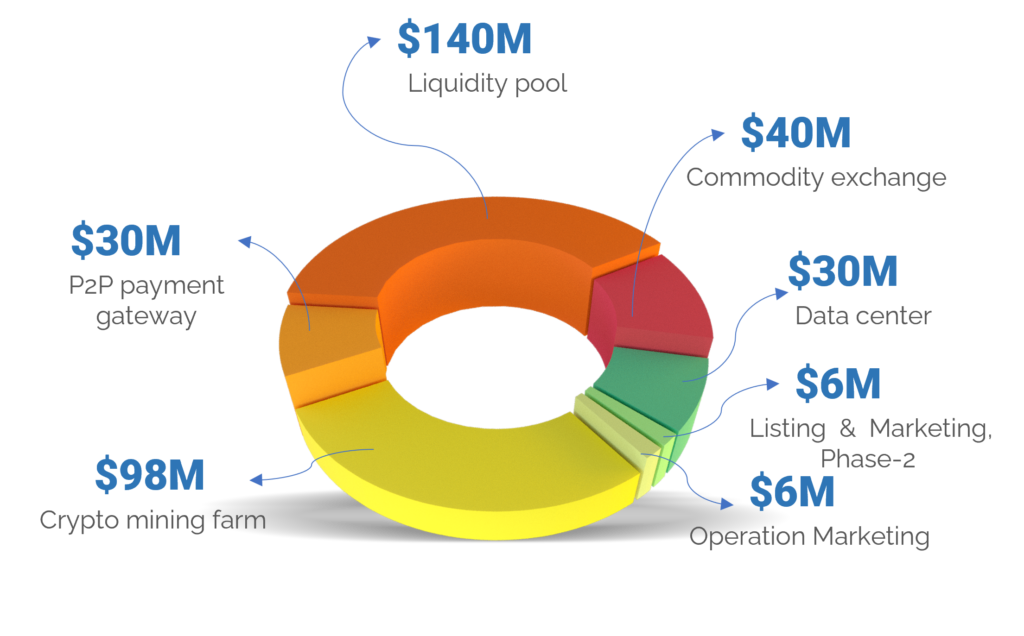

$350M DISTRIBUTION